Coinbase Overview

Introduction

Founded in 2012 in San Francisco, Coinbase is the largest cryptocurrency exchange in the U.S. and is one of the biggest crypto exchanges worldwide. Coinbase is publicly traded, has more than 70 million verified users, and is available in over 100 countries – so it’s easy to see why Coinbase is an institution in its own right.

Coinbase has three core products; the basic Coinbase crypto brokerage service for retail customers, the Coinbase Pro exchange for the more professional trader, and Coinbase Prime for institutions. For basic comparison purposes, we will mainly talk about the retail and pro products in this review. You can use both Coinbase and Coinbase Pro products with the same credentials, but there are many differences between the two.

Is Coinbase safe?

It is a well-known fact that investing in cryptocurrencies is inherently risky. Recent news reports are rife with stories of hackers accessing crypto wallets and stealing users’ details. This begs the question: Is Coinbase safe?

For the most part, yes, but how you define ‘safe’ is up to your own interpretation. In October 2021, Coinbase reported that they suffered a hack earlier that year, with some 6000 users affected. This, however, was most likely down to phishing emails which Coinbase explicitly warns users about while using both the mobile and desktop versions of their platforms. The good news is that affected users were compensated by Coinbase, which gives added peace of mind in the unlikely event this happens to you.

That being said, Coinbase does have many security features of its own to ensure the safety and security of your cryptocurrencies and wallet. To comply with KYC (Know Your Customer) regulations, Coinbase is required to identify users on their platform. Although the lack of anonymity may be unappealing for some, this essential security feature adds additional safety as it deters any illegal activity. Users are required to submit a government-issued ID and sometimes will be asked for address verification.

Like most other crypto exchanges, Coinbase offers 2-factor (2FA) authentication. You will need to provide a unique verification code that is sent to your phone in addition to your username and password. This can be less secure than other security measures, so Coinbase also offers a security key option, which means any would-be hacker/attacker would need your physical 2FA device. The digital wallets and private keys also use AES-256 encryption.

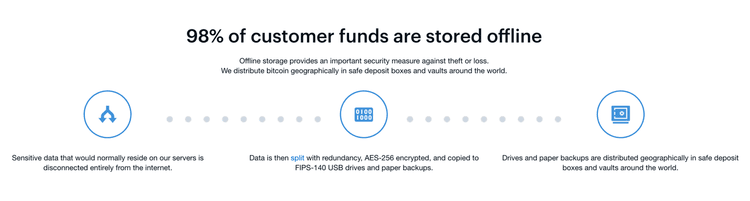

In addition to 2FA, Coinbase uses cold storage to keep assets safe. This means that 98% of all customer funds are stored offline and distributed in safe deposit boxes in different locations worldwide. The remaining 2% of funds are available online in hot wallets insured by Coinbase, meaning that if your funds are compromised, Coinbase should reimburse you.

For U.S customers, Coinbase also offers insurance on deposits of $250,000 per account through FDIC insurance.

Getting Started

Assets & Pairs

The Coinbase brokerage service currently offers up to 150 different cryptocurrencies for spot trading and is supported in over 100 countries worldwide. Coinbase Pro gives traders access to over 360 trading pairs, and the list continues to grow. However, depending on your investment strategy, Binance still trumps the market with access to over 1200 trading pairs.

Sign-up / Verification Process

Coinbase makes it easy and straightforward to sign up for its service. You need to be 18 years old, and, to comply with KYC regulations, Coinbase requires proof of identity. You need to verify your identity before buying, selling, or transferring any funds. The easiest way to do this is by using the Coinbase app to take a photo of a government-issued identity document. We used a driver’s licence to verify our account and the process was smooth and easy. Coinbase also required us to verify our mobile number and set up two-factor authentication before we could start using the service, which once again was done quickly.

Our entire experience signing up to Coinbase was very positive. It took us less than 5 minutes to go from downloading the app to receiving the confirmation email.

Funding Methods

Depending on your geographical location, Coinbase offers several different options to buy crypto or add funds to your account.

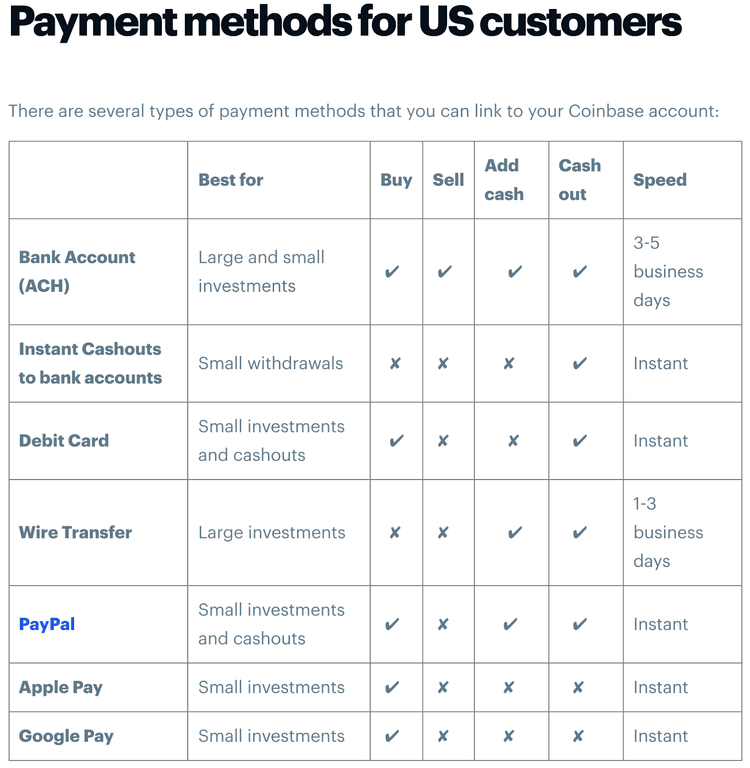

U.S. Customers

For U.S. customers, 5 different options are available. Payment via debit card, PayPal, Apple Pay, and Google Pay will allow you to make instant cryptocurrency purchases. A complete list of details on other funding methods can be found below.

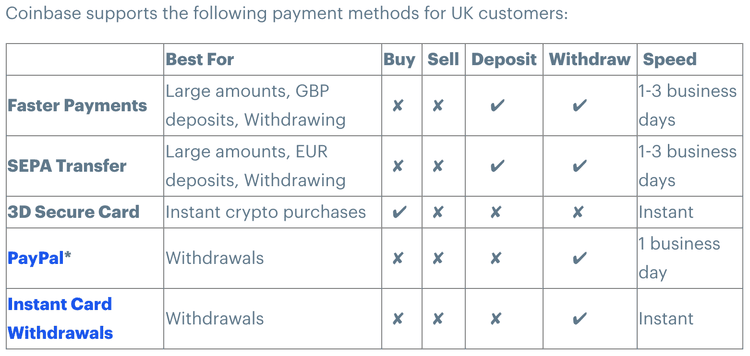

UK Customers

For customers in the UK, linking a debit card to your account allows you to instantly purchase cryptocurrency with a limit of £3000 per day. For larger amounts, a bank transfer option is available for larger amounts, but this can take between 1 -3 business days. A full list can be found below.

European Customers

Coinbase supports instant transactions for customers in Europe if you use your debit card or Apple Pay. SEPA transfers are supported for larger amounts but can take between 1 – 3 days to clear. A full list can be found below.

Withdrawals

Withdrawals with Coinbase are simple. Whether you’re a U.S., UK, or European customer, withdrawals via the app or desktop platform take no more than a couple of clicks. We tried the fiat withdrawal, and we were impressed with how effortless it was.

Fiat Withdrawal

If you want to withdraw fiat currency from Coinbase, you will need to sell some crypto first and use the ‘Instant cashout’ option. A relevant wallet is necessary depending on your intended currency and location, for example, a GBP wallet for UK customers or USD wallet for U.S. customers. You will also need to link a bank account to your Coinbase account, which is done by depositing some funds from your bank account to your Coinbase account.

Once you’re ready to sell and withdraw, simply select ‘Trade’ on the relevant asset, and you will be given an option to sell your crypto. You will then need to go to your currency wallet and select ‘Cash Out’ and the funds will be in your account shortly.

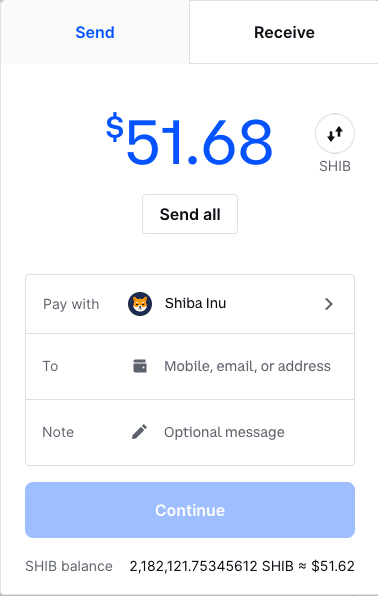

Crypto Withdrawal

If you want to withdraw crypto from your Coinbase account, sending it to your Coinbase Wallet would be the easiest way. Doing it this way allows you to send it to an email address or username rather than using a traditional wallet address. We’ve outlined more about the wallet in the ‘Coinbase Wallet’ section of this article. Sending it to an external wallet is much the same process; you will just need to specify and confirm the wallet address.

Just click on ‘Buy/Sell’ at the top right corner of your dashboard, and you’ll be taken to a withdrawal screen. Coinbase states on their website that in most cases, withdrawals take about 60 seconds, but as per their terms, some transactions to external digital wallets will require additional confirmation depending on the digital currency network.

Fees

With different products on offer by Coinbase, pinpointing exact fees becomes a bit more confusing and challenging. Coinbase doesn’t explicitly give a breakdown of fees for their brokerage service, but we managed to hash it out.

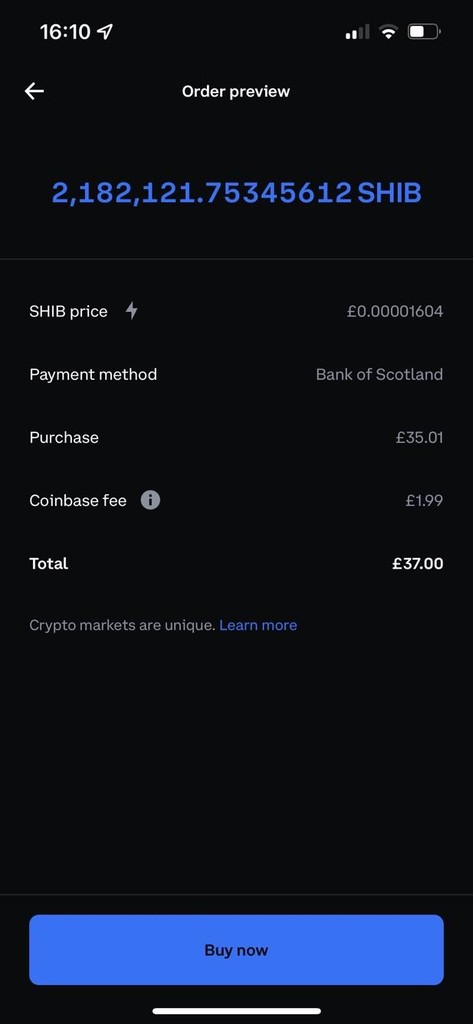

Coinbase

For the basic Coinbase brokerage service, Coinbase charges a fee per trade depending on the amount and payment method used, which can be as little as $0.99 for $10 or less, or $2.99 on a trade between $50 – $200. Trades above $200 have a percentage-based fee rather than a flat fee. Coinbase also charges a spread of up to 0.5% for crypto sales and purchases, which can change depending on market fluctuations. The spread is the difference between the bid and the asking price of the currency.

So if you were to buy $200 worth of Dogecoin with your debit card, you’d pay a higher fee of $4 (2% card fee) instead of the $2.99 flat-rate fee along with the spread.

We consider the fees of the basic Coinbase platform to be rather high. If you intend on trading or buying crypto on a regular basis, we recommend that you get acquainted with the Coinbase Pro platform and benefit from the lower fees there.

Coinbase Pro

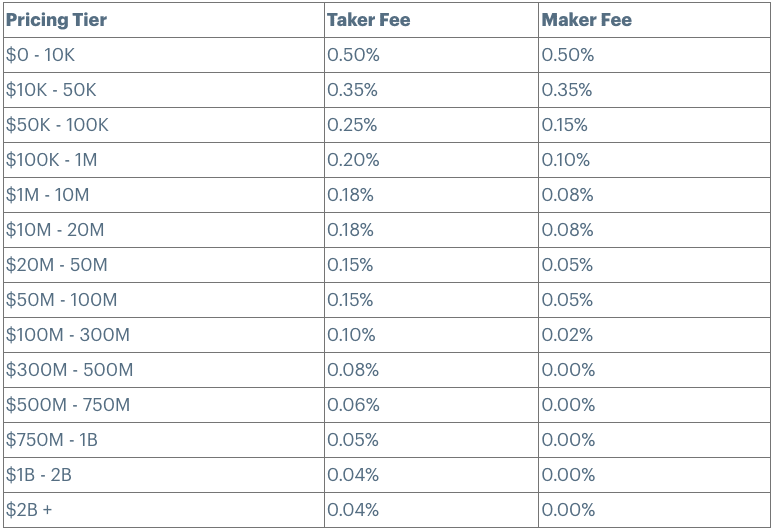

Coinbase Pro uses a maker-taker fee model to determine its trading fees, a much simpler fee structure than the basic Coinbase service. As explained on their website, when you place a market order that gets filled immediately, you are considered a taker and pay a fee between 0.04% and 0.50%. When you place a limit order, which is not instantly matched by an existing order, that order is placed on the order book. If another customer places an order that matches yours, you are considered the maker and will pay a fee between 0.00% and 0.50%

While this seems a whole lot more straightforward, bear in mind you can’t use a debit or credit card to purchase cryptocurrency on Coinbase Pro. So, for the trader looking for a convenient way to buy crypto and trade smaller amounts, it’s probably best to stick with the basic Coinbase brokerage service, even if it is slightly more expensive. But, if you want to buy and trade multiple times, Coinbase Pro, with its simpler fee structure, is probably better suited for your needs.

The Platform

Platform & Ease of Use

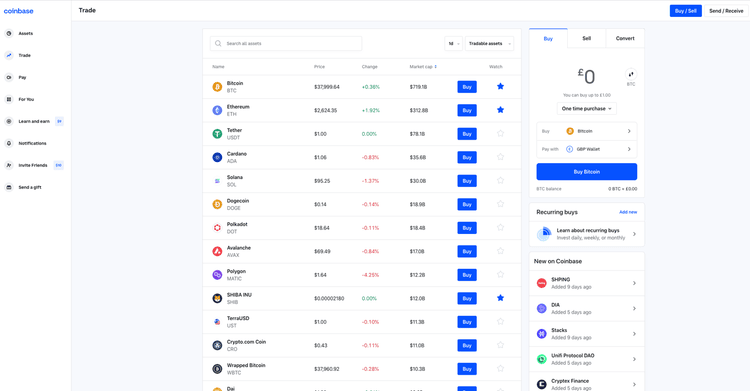

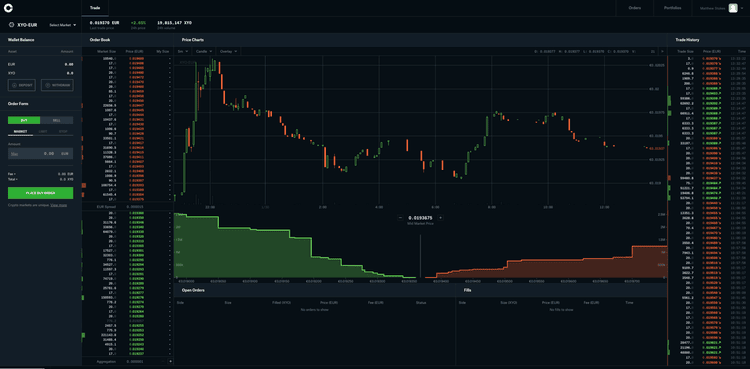

When it comes to simplicity and ease of use, Coinbase knocks it out of the park. The highly user-friendly platform will make even the most beginner trader feel confident in getting to grips with both the mobile and desktop versions of the platform. Coinbase Pro offers advanced charting features and crypto-to-crypto trading pairs for the more advanced trader.

When using the platform, you’ll immediately appreciate the convenience of a clean interface with minimal options when using the platform. Coinbase makes it easy to buy, sell and withdraw your crypto. Users can switch between different tabs seamlessly and view up-to-date crypto-related news and offerings.

As a Coinbase brokerage customer, you are able to use the Coinbase Pro service with your same credentials but will be subject to different terms and conditions and Coinbase Pro fees. The platform offers real-time market prices/live order books and more advanced price charts, as well as access to trading pairs. The user experience is excellent, and the stop and limit orders are especially appealing features.

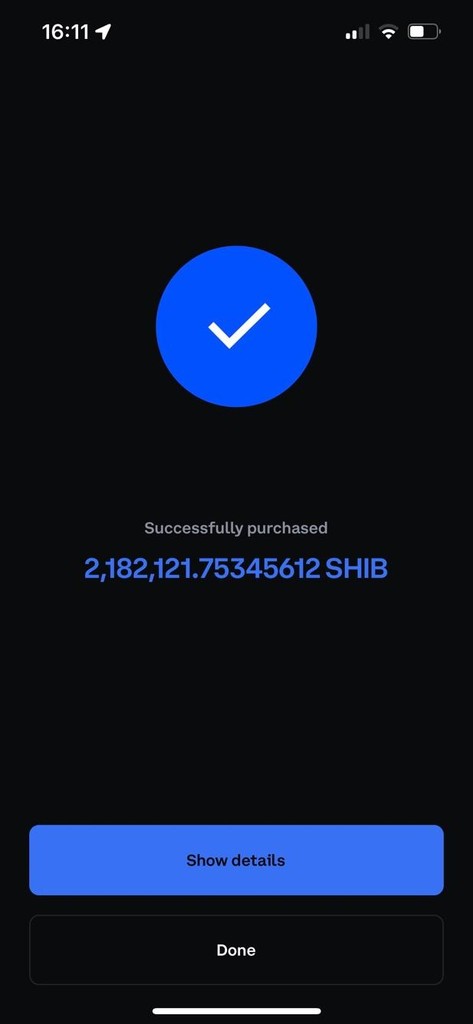

Mobile App

Coinbase has a few different mobile apps depending on which product you’re using. We tried the Coinbase app and Coinbase Pro app. A Coinbase Wallet and Coinbase Prime app (for institutions) is also available. The Coinbase app is excellent for beginners, giving you the ability to buy and sell crypto and view all of your available assets. We even earned some crypto via their ‘Learn and Earn’ function, which incentivises you to learn about different cryptocurrencies and pays you a small amount of crypto along the way.

We tried purchasing cryptocurrency via the Coinbase mobile app and were impressed by its simplicity. Within two clicks, and after entering the amount we wanted to buy, we were taken to the preview screen, ready to approve the purchase. If we had to nitpick, however, we disliked that Coinbase doesn’t offer a proper breakdown of their fees before purchasing. Instead, you have to hunt these down yourself. Despite this, we enjoyed how easy it was to purchase crypto using the app.

The Coinbase Pro app is geared more towards experienced traders. The app lets you see what the desktop version does but in a more condensed form. It is a good and reliable app, but if you are really interested in trading, we recommend using the more advanced desktop app to view more in-depth charts, a better analysis of trading pairs, and live order books all in one user interface.

Trading Features

Depending on your investment strategies and goals, Coinbase has a number of features that cover most bases. For beginners and spot traders looking to simply buy and sell, Coinbase lets you do just that. Coinbase performs the basic function of an exchange really well.

For experienced traders, the trading features are a mixed bag. On one hand, Coinbase Pro gives you most of what you need with advanced graphs and charts, stop loss and limit sell options and trading pairs and markets. On the other hand, Coinbase does not support margin trading, using leverage to trade, or short selling. Whether or not you should use Coinbase really depends on your trading strategy, as some strategies will be impossible to implement on Coinbase.

Volume & Liquidity

To put it simply, liquidity refers to how easily an asset can be exchanged for another asset or fiat currency. The higher the liquidity value, the easier it is to trade. As one of the largest cryptocurrency exchanges available, Coinbase naturally has an ample supply and demand for many different cryptocurrencies. CoinMarketCap, gives Coinbase an average liquidity rating of 702 out of 1000, ranking 4th in their list of 314 exchanges. At the time of writing, Coinbase has a daily trading volume of $2.5 billion, which ranks easily within the top 10 trading platforms worldwide.

At the time of writing, Bitcoin to USD (BTC/USD) on the Coinbase exchange had a liquidity rating of 852, and a smaller volume pair like Polkadot to USD (DOT/USD), had a liquidity rating of 622. No matter who you are and how much you trade, you won’t have to worry about liquidity on Coinbase.

Additional Features

The Coinbase Wallet

Coinbase comes standard with its own integrated wallet that can be used to store crypto and access assets for trading purposes. But, they have also developed a separate wallet service called The Coinbase Wallet. Having a separate wallet isn’t necessary if you just want to do a bit of spot trading and learn more about crypto trading. It does come in handy, however, for more advanced trading features or when you are trading large volumes and want a more secure storage solution for your crypto.

Coinbase and The Coinbase Wallet are two separate apps and the primary use of the wallet is more geared towards the storage of crypto, NFTS, and data. You can also use it to receive digital assets, ERC-721 NFT tokens, and ERC-21 fungible tokens. What’s more, the Coinbase wallet allows you to store thousands of tokens and coins not supported by the standard integrated Coinbase wallet.

The thing we loved most about the Coinbase wallet is that you can allocate a username to your wallet. This lets you assign a much easier address to which any other wallet user can send funds to or make payments without having to use alphanumeric characters used by most other blockchain networks.

So, for example, you could make your username ‘@MadCrypto’ instead of having a cumbersome crypto address like ‘43c0vDSDSADFxF54267c567fgty43645HJk’. This makes the wallet easier to use and mitigates the risk of losing your cryptocurrency forever by accidentally not typing the crypto address correctly. This makes using the Coinbase wallet as easy as sending funds between PayPal accounts.

It’s important to note that Coinbase has no access to any wallets or funds and can’t guarantee their safety. It is solely up to the user to safely store and protect their own wallet.

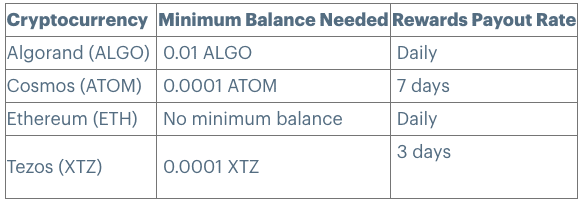

Staking

Staking is a great way to maximise your crypto by allowing you to earn interest on it. Coinbase allows you to earn up to 5% APR on your crypto, but unfortunately, only 4 cryptocurrencies are available for staking, which is very low compared to most other exchanges. Coinbase also takes a 25% commission cut on any rewards made from staking.

Coinbase’s staking offering really limits your ability to maximize the returns on your crypto. If staking is a key feature for you, other exchanges like Binance or Kucoin might be better suited for your needs.

To be eligible for staking rewards, you must verify your identity, have the minimum balance needed for the specific cryptocurrency, and must hold the eligible cryptocurrency.

Customer Support

Coinbase has a comprehensive support section with many helpful articles and the option to speak to a virtual assistant. We tested several queries around 2FA, fund withdrawal, and adding funds to our account and found the answers pretty quickly. However, what we found most frustrating was not being able to immediately speak to a human being about an issue. After filling in a form, it took just under 48 hours to receive a response from an agent.

Coinbase does offer phone support, but according to customers on Trustpilot and Better Business Bureau (BBB) they’re not so responsive or easy to get a hold of. Coinbase addressed these issues in a statement published on their website in January 2021 and reaffirmed their commitment to provide a better experience, but we consider waiting 48h for a human answer to be too long.

NFTs

At the time of writing, Coinbase only allows you to store non-fungible tokens (NFTs) in your Coinbase wallet. This is all set to change very soon, though, as Coinbase is working on releasing their new NFT marketplace product. Coinbase has also teamed up with MasterCard to make buying NFTs as easy as purchasing your morning coffee. This could revolutionise the way people purchase NFTs, as currently, they can only be purchased with cryptocurrency (mostly ETH).

This feature will only be available in the U.S. to start, and customers can join a waiting list in order to get early access to the marketplace. Signing up will also keep you updated on any other NFT marketplace news. Over 3 million people have already shown interest. We signed up and are a cool 3,346,196 in the queue!

Conclusions

Conclusion for Beginners

Coinbase offers the perfect platform for beginner and novice traders to learn more about different cryptocurrencies, how cryptocurrencies work, and how to buy and sell their first crypto. The user interface is very straightforward, and navigating your way around is easy and less daunting than on most other platforms. The biggest downside is the high fees associated with the Coinbase brokerage service, but that is the price to pay for simplicity.

If you want to learn or do a bit of spot trading, we recommend using Coinbase. If you’re looking to simply buy and hold crypto, Coinbase offers a secure platform in which to do so, with an attractive offering of cryptocurrencies available. Coinbase Pro is a great product that will allow you to grow into the platform and become an intermediate trader should you wish to deepen your trading knowledge. We don’t advise anyone but the most sophisticated users to use margin or leverage, so you shouldn’t miss it too much.

Conclusion for Experienced Traders

Coinbase Pro offers an excellent trading platform for more adept traders. The interface is sleek and advanced, and fees are attractive with free withdrawals to your bank account. The service is secure with insurance from Coinbase in the event that a breach does occur. Coinbase is a good exchange for intermediate users, but if you really want all the bells and whistles, Coinbase Pro isn’t for you as lacks support for short selling, margin, and leverage. If these features are important to you, we suggest you look at other platforms like Binance or Kucoin.